Credit Risk Decisioning systems lie at the heart of financial institutions and are increasingly becoming the ideal candidate for further optimisation of customer interactions. They provide a systemised approach to evaluating the creditworthiness of borrowers be they consumers, small businesses or corporations. This process utilises various data sources including credit history, repayment capacity, financial stability, and more, to calculate risk scores and responsible lending for potential borrowers. Credit Risk Decisioning systems are a critical to the credit lending lifecycle and are a central to how financial institutions operate.

Strategic investment into these fundamental systems enable credit providers to make quicker more accurate and automated credit decisions enabling them to gain a competitive advantage over their competitors.

Legacy Credit Decisioning Systems

Almost all credit providers have their own versions of Credit Risk Decisioning systems in place. These systems have either been purchased off the shelf and customised or custom built internally.

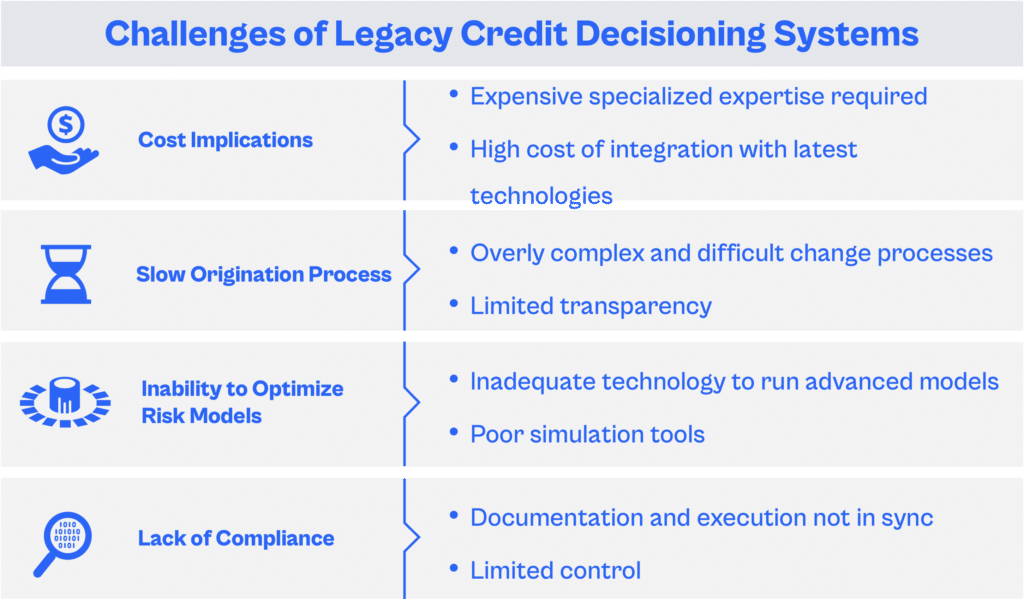

Either way they’ve been around for a long time and grown incrementally over many years with extensive customisations, often using outdated legacy technologies. Legacy Credit Decisioning systems present several operational challenges for technology and business teams alike.

Most industry experts are predicting the demand for consumer credit to grow exponentially over the next few years, meaning an ever-increasing number of credit requests, products, data sources and regulatory constraints will be introduced. This will subsequently put credit providers and their, creaking, legacy Credit Decisioning systems under substantial pressure to ensure responsible lending, consumer satisfaction and overall standards are maintained.

Embracing change and modernising Credit decisioning systems is vital for credit providers globally. The failure to do so could lead to loss of revenue, market share, reputation or even significant penalties and fines from regulators.

Pega Customer Decision Management

Pega’s Customer Decision Management (CDM) is fast emerging as a valuable Credit Decisioning technology option for credit providers. Built on the market leading low-code Pega Platform, the CDM stands out as a truly integrated credit risk management and decisioning system that enables the efficient managing of significant workloads, services, data sources and integrations in full compliance with regional regulations.

Pega stands out for its cloud capabilities, enhancing operations with scalability, flexibility, and cost savings by eliminating the need for on-premises hardware and maintenance. Additionally, its low-code platform simplifies the development process, reducing the reliance on technical skills enabling greater collaboration between business and IT teams. This not only increases efficiency and speed to market but also leverages Pega’s DevOps features for quicker and more reliable deployment and governance.

What truly sets the CDM apart is the seamless integration of these features, making it a desirable migration option in the credit risk decisioning space.

DCS – Experts in Migration and Modernisation

Large technology modernisation/migration projects are a daunting prospect for organisations to undertake. They are complex, expensive and time consuming, require careful planning and project management expertise, all while balancing the technical requirements with strategic business objectives and ensuring BAU operations continue as normal.

As Pega Decisioning and migration experts, our highly skilled and capable architects have extensive end to end experience of successful large scale Pega Decisioning migration projects with a number of our clients. We acknowledge the difficulties that businesses and their operations teams face during this process and understand the importance of ensuring the integrity of current services, and above all regulatory compliance is maintained at all times.

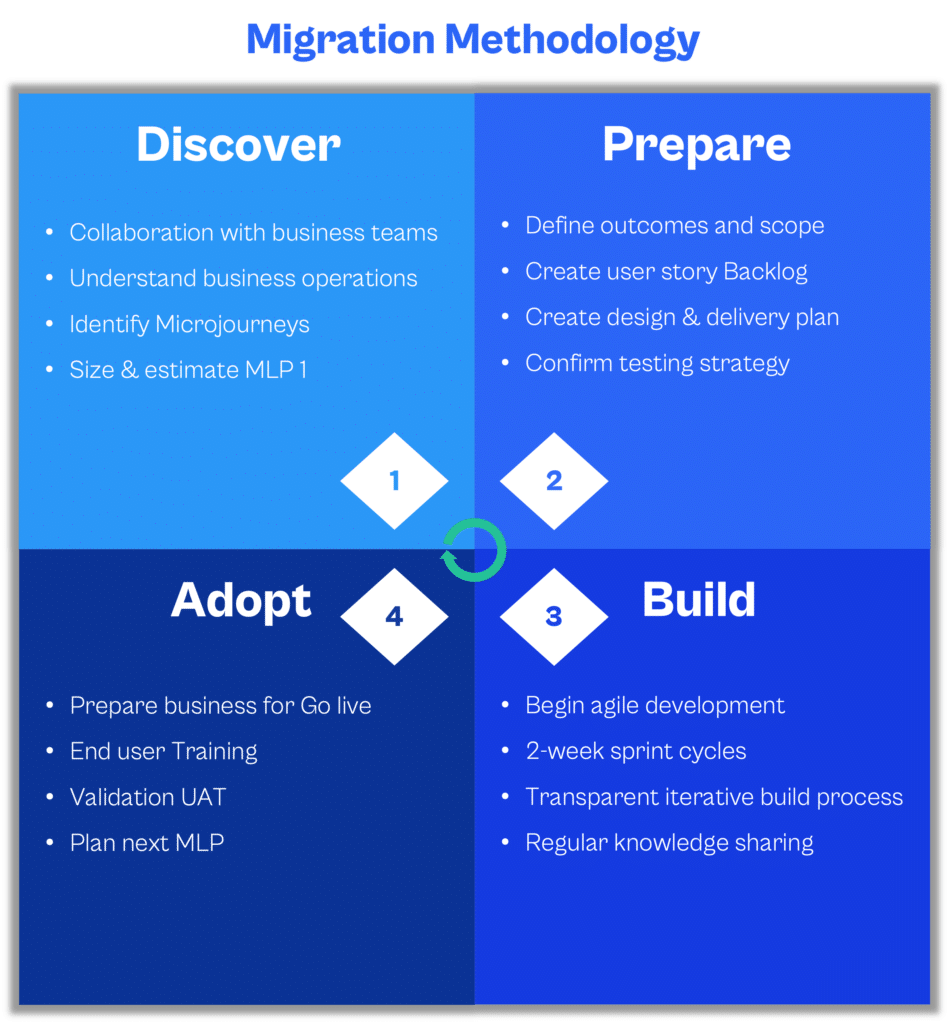

Our proven migration methodology aligns closely with the Pega Express delivery Centre-out approach, mitigating risk and speeding up the development process. By identifying and prioritising high value frequently used business services or operations that can be broken down into deliverable work packages called Microjourneys. These work packages can be implemented and delivered quickly as an MLP 1 (Minimum Loveable Product), within 12 weeks. This approach ensures our clients can see the benefits of the migration process as quickly as possible and is one of our fundamental objectives when working with clients.

Collaboration with client teams during the ‘Discover phase’ enables us to gain valuable insight into operations and understand how each business unit interacts with the existing system. This process helps to build a picture of the requirements and the impacts the migration process will have on the overall system infrastructure.

Our design team uses the knowledge gathered to influence and guide the ‘Prepare’ phase ensuring business outcomes, scope and resourcing are clearly defined and align with the clients’ requirements. During this phase the project delivery plan is defined, a backlog of work items is created and broken down using the Agile Scrum methodology. Also a supporting governance process is put in place to ensure roles, responsibilities and processes are in keeping with best practise guidelines.

What really sets the ‘DCS approach’ apart is the care and attention we bring to the ‘Build’ and ‘Adopt’ phases of the delivery. During the ‘Build’ phase our developers use reusable and scalable design patterns; reducing complexity, removing dependencies and optimising processes. This method helps create a tailored solution that is simple to use and suitable for end users.

We know technology migration projects are quite challenging and often stressful, especially for risk managers who use the system in their daily roles. This is why throughout the ‘Adopt’ phase we invest the time and effort to provide client teams with all the expertise and the support they need. Our Credit Risk Pega training course takes client teams through the BAU process and how best to make changes and utilise their new Credit Decisioning solution. By building up their confidence to continue to do their role during and post migration. This is an essential part of any migration process and often gets overlooked.

Our principal goal is to make the migration process as smooth and as transparent as possible, delivering a solution that the client and their teams can utilise and see the rewards quickly with minimal disruption to business and operations.

There are a number of innovative service offerings and approaches that DCS offers in the Pega Decisioning and Credit Risk space, see our Pega market place submissions here.

Introducing DCS Credit Decision Services (CDS)

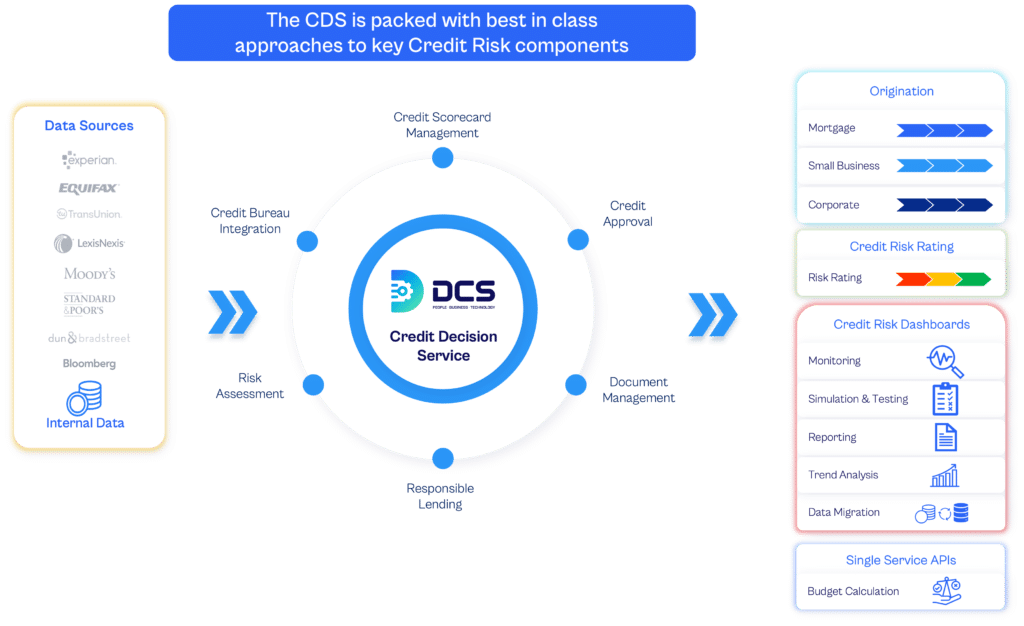

Drawing from our rich experience working with top-tier organizations and institutions in the credit risk and lending field, we’ve crafted our very own Credit Decision Service (CDS). This is our first step into offering a specialised service for the credit risk sector, using Pega’s renowned Customer Decision Management.

Our service is designed to make the credit decision processes smoother, smarter, and more scalable. We have merged our deep understanding of Credit Risk with Pega’s advanced decisioning technology modernizing the way in which Credit Risk systems operate and function.

The CDS provides access to components such as Credit Decision or Responsible Lending but also innovative Credit Risk dashboards, Simulation, Reporting and Data migration capabilities. These in-built features offer lenders the ability to visualise, analyse, and monitor their live production environments in real time.

With the Data migration feature, Risk managers are able to effortlessly migrate data between production, business operations and/or sandbox environments for further detailed analysis. The simulation capabilities offers risk management the ability to; test and learn, compare and contrast, run champion challengers on the credit policies, rules and risk models. They can then use the pre built industry standard reports to provide further insight and transparency required for regulatory compliance.

Bundled with the CDS comes our own Credit Bureau service connectors which are capable of extracting data from third-party credit data providers. This unique feature provides Credit lenders the ability to seamlessly integrate data from external sources with owned first party data to further enhance Credit policies, Risk assessment and Credit Decisions.

In summary, the CDS provides financial institutions with a fully integrated Credit Risk Decisioning solution, packed with a plethora of innovative features and tools that are essential for Risk managers to simplify processes, comply with regulations, make faster more informative decisions and most importantly provide an improved robust service to consumers.

This service can be easily integrated with existing services and data infrastructure, for further more technical information about the CDS please contact DCS via the Pega Marketplace here

About DCS

We are a Pure-Play Pega Partner and team of decisioning experts providing advisory, implementation and on-going managed services for enterprise clients globally. Working in partnership with enterprises, we help leverage the power of Pega’s AI, next-generation AI and decisioning capabilities to deliver 1:1 Customer Engagement, Credit Risk and Intelligent Automation solutions. With offices in the UK, Netherlands and India coupled with planned expansion into the US and APAC markets our team of over 100+ Decisioning Consultants have expertise across a range of industries – including Financial Services, Communications & Media, Insurance and Retail sectors.

About the Author

Pradeep Warden is a Lead Decisioning Architect at DCS, with over a decade of experience in the Financial Services, Banking, and Telecom sectors. Since joining the company over three years ago, Pradeep has been instrumental in spearheading several pivotal Legacy to Pega migration projects, working with technologies like Oracle RTD, Chordiant, and Unica. At present, he heads the Credit Decisioning Design & Innovation team, applying his deep technical and domain knowledge to drive innovations in Pega.

Pradeep’s blend of technical expertise and consultancy skills has not only been crucial in navigating complex projects but has also helped organisations he has worked with make the most of their Pega Decisioning capabilities. His contributions are particularly noted in the Credit Risk Decisioning and 1:1 Customer Engagement spaces, where his work continues to make significant impacts.